General Dynamics Stock: Safe Hedge Against Inflation & Geopolitical Risks (NYSE:GD)

[ad_1]

guvendemir/E+ via Getty Images

Investment Thesis

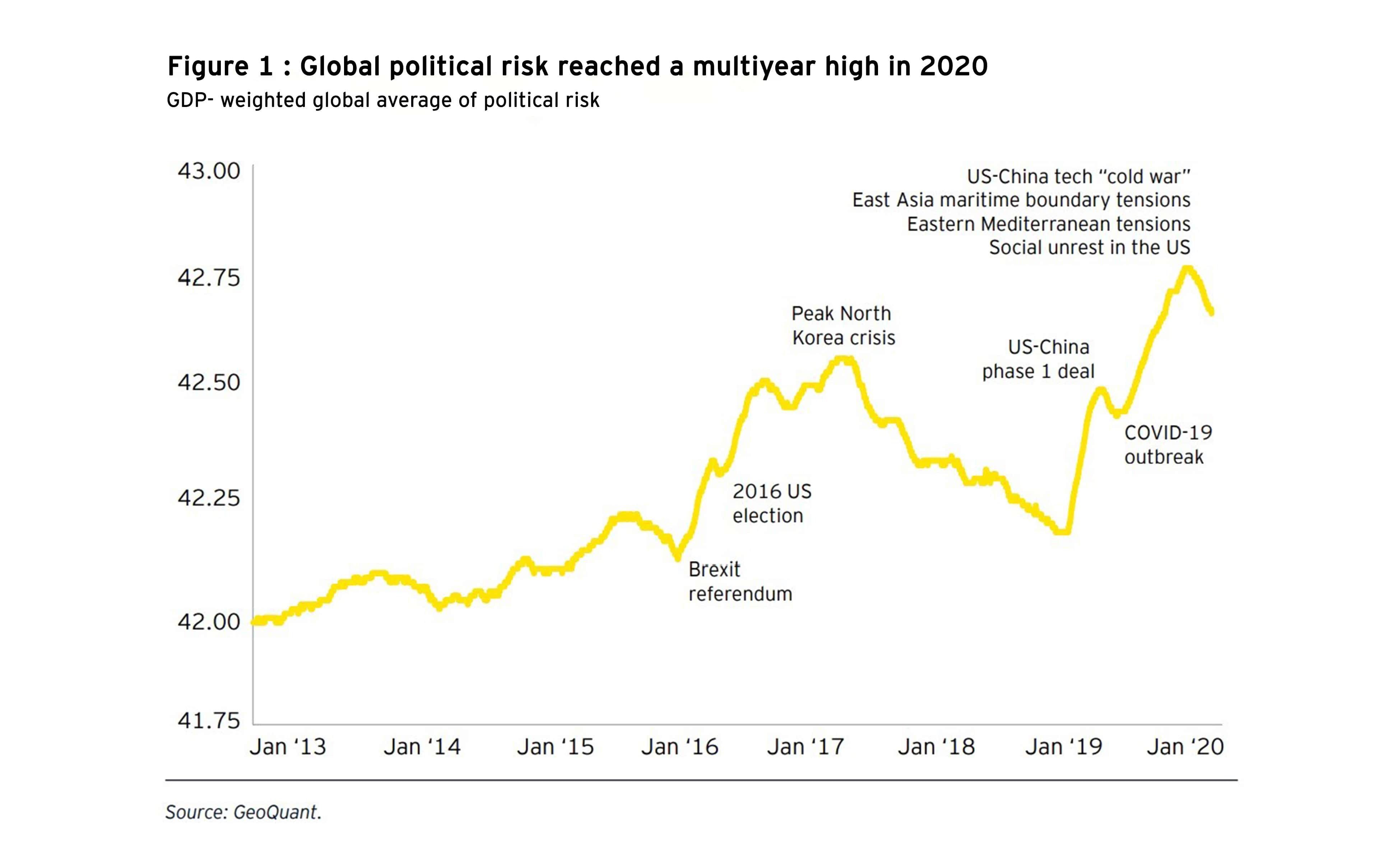

The aerospace and defense industry offers a nice investment cushion amid the growing global geopolitical instability and inflationary pressures. The stocks in this industry are precedented to outperform the market in times of conflict. With the Russia-Ukraine situation on the world stage right now, China is surely studying the global response as it eyes Taiwan backstage, undoubtedly, pumping into defense stocks.

On the off-chance that the geopolitical tensions subside, the economic rebound will be swift as the Fed is already taking measures to curb the soaring inflation. This will, again, result in the aerospace and defense stocks gaining as it’s a cyclical industry.

General Dynamics (NYSE:GD) is a strong contender in the aerospace & defense industry with revenue-generating segments including aerospace (21% of revenue), combat systems (19% of revenue), marine (27% of revenue), and technologies (33% of revenue). The company has shown strong gains in the previous 52 weeks and YTD, outperforming the market.

With its aerospace demand back on track, its upward trajectory is taking a flight to new heights with about 4% expected growth in 2022, up from 0.7% in 2021. If the company delivers its Gulfstream demand, Forecast International expects Gulfstream to rank at the top of the business jets market in dollar amount.

Its marine segment has shown strong growth for the 4th consecutive year and is expected to show stronger, almost 15% YoY growth in 2022. The technology segment, which makes up one-third of the company’s revenue, is expected to rise by over 3%.

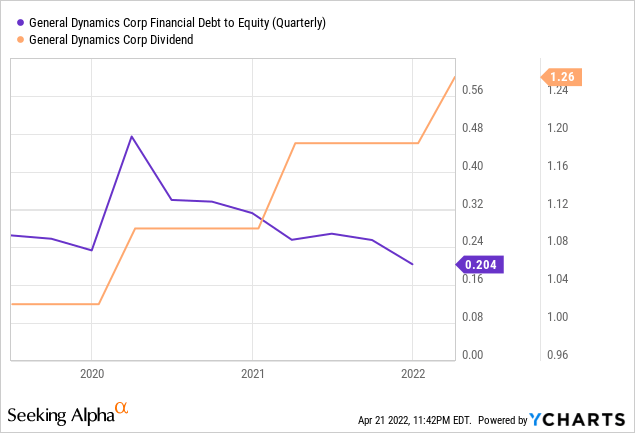

The company has sequentially lowered its debt since Q1 2020, lowering its risk profile and improving its debt metrics, meaning higher earnings and cash yield, translating to safer dividends.

The positive financial performance and the overall rise in the defense sector will result in strong gains in the coming years. With a time horizon of at least 5-years, investors can expect to outperform the market by a wide margin on the back of a favorable geopolitical situation.

Defense Stocks and Geopolitical Tensions

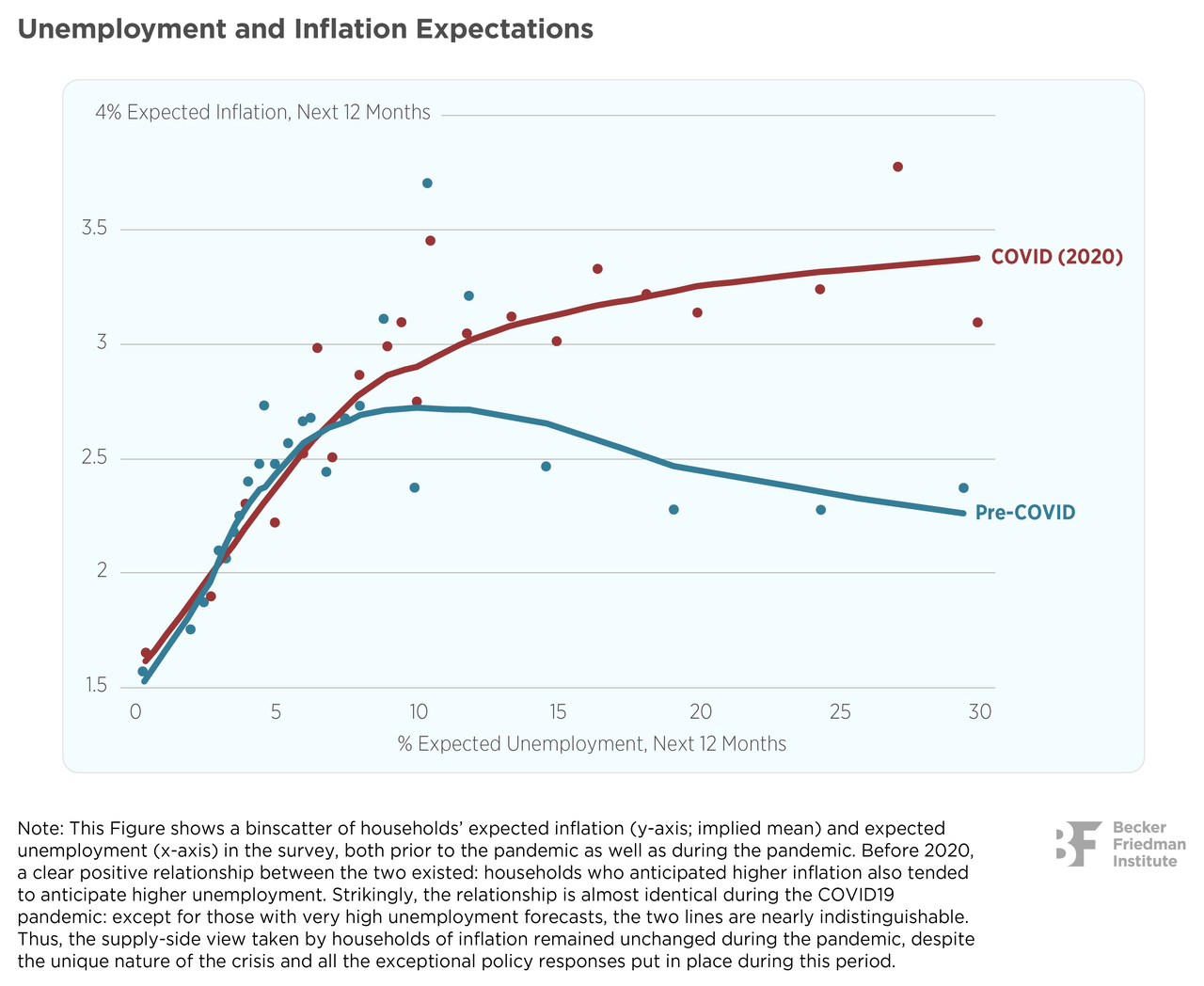

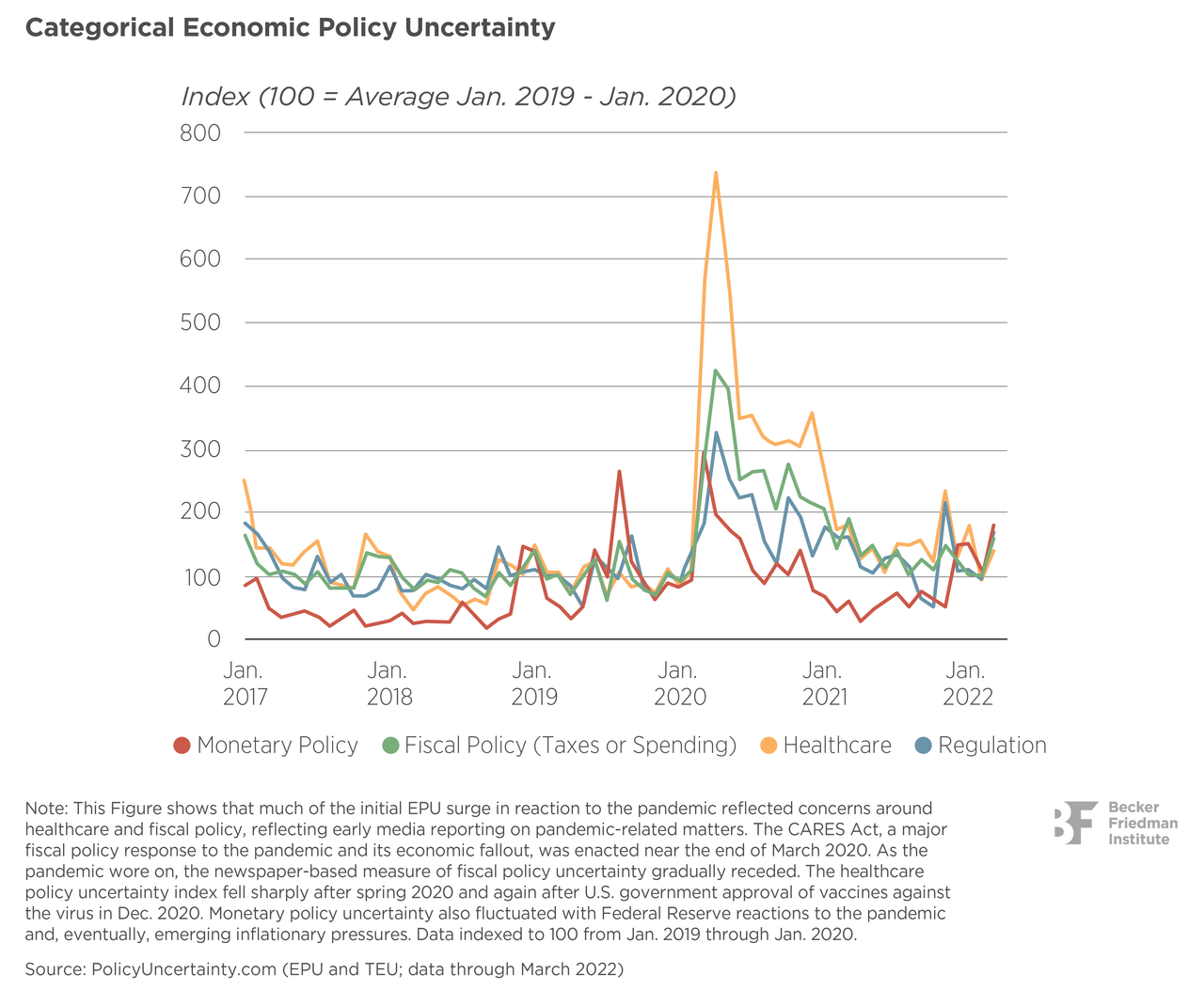

In 2020, the pandemic took aback the world, resulting in a global downshift and market slump, triggering the government’s economic support and inducing record-level inflationary pressures. This was followed by a periodic rebound in 2021 but accompanied by a storm of economic uncertainty, resulting in a predicted recession in 2023.

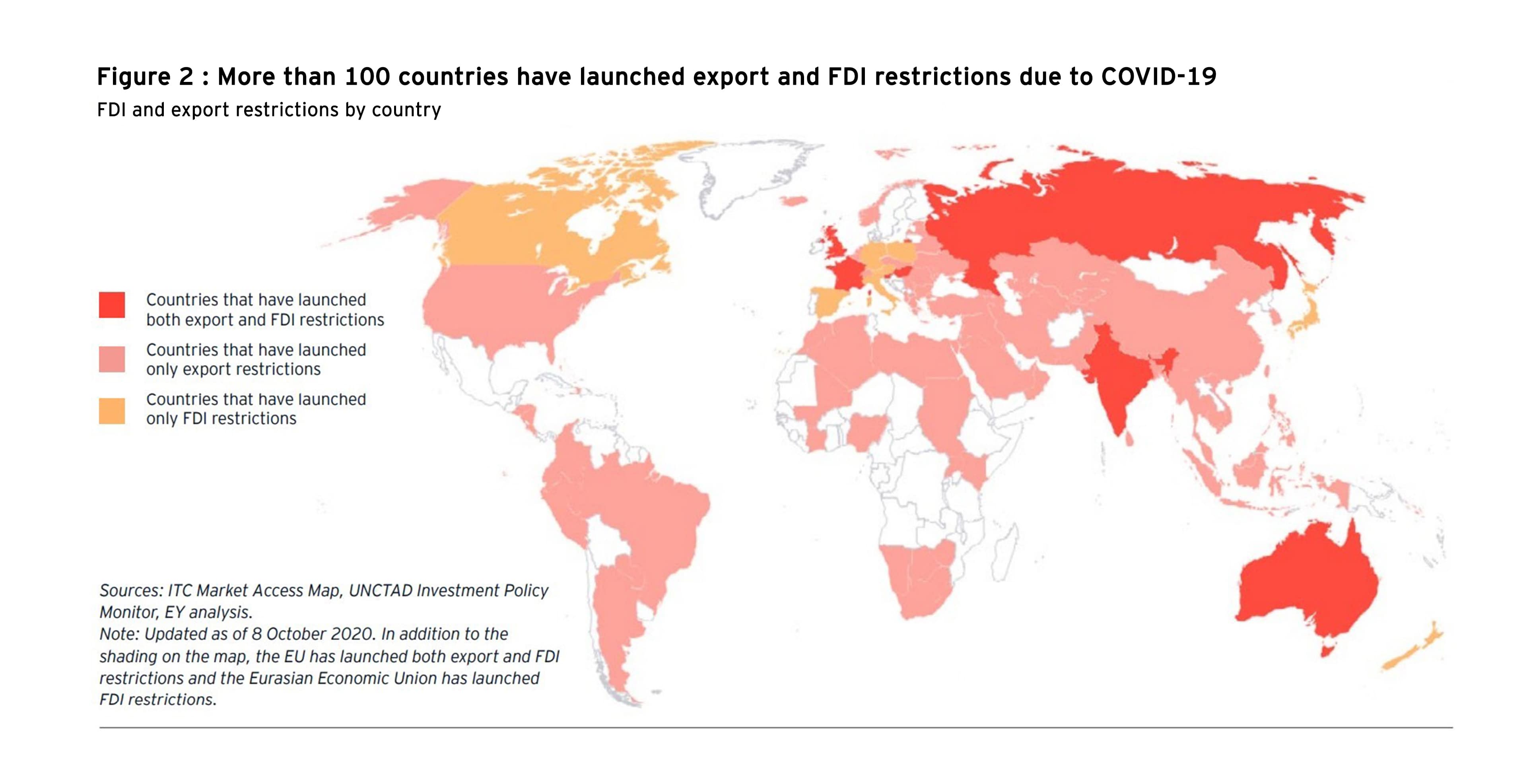

Becker Friedman Institute

All these circumstances were facilitated by rising geopolitical tensions, including Foreign Direct Investment (FDI) limitation but remained largely in the backseat amid the chaos.

Ernst & Young

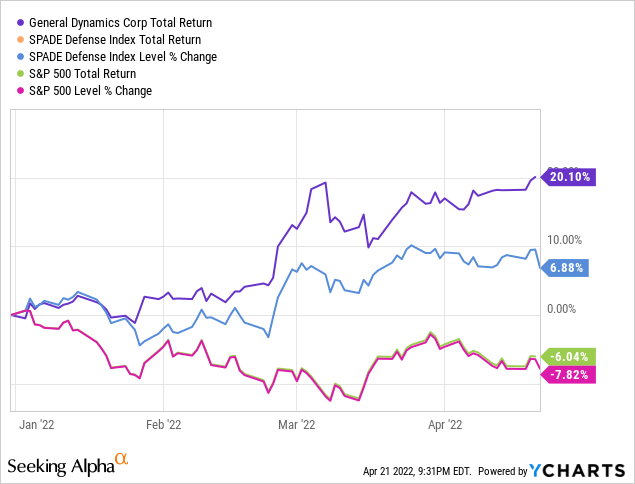

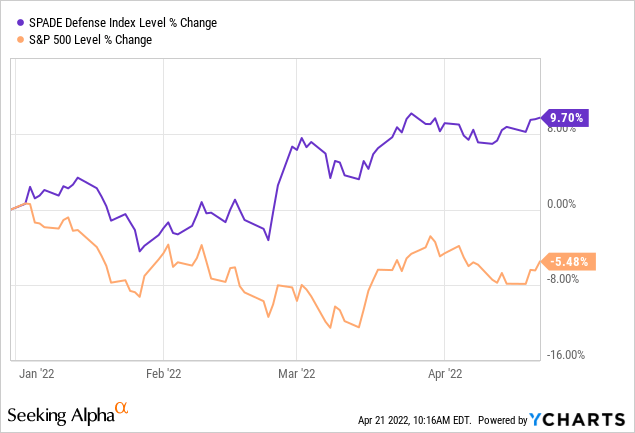

Now that the pandemic has largely subsided and the geopolitical situation is calling “shotgun,” the aerospace and defense industry has started to take the driving seat. In fact, the SPADE defense index, which has historically lagged the S&P 500 index in normal times and has outperformed it during times of conflict, has outperformed the S&P 500 YTD by a wide margin.

It has further been noticed that historically, after a decline of 2 to 3 years, defense stocks subsequently outperform the market for multiple years and, in the long run, result in an outperforming gain. In fact:

In each of the past two decades, 2000-2009 and 2010-2019, the SPADE Defense Index outperformed the S&P 500 by nearly 120%+.

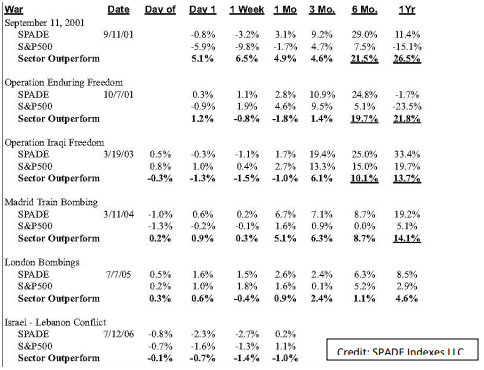

According to the SPADE index reports, the maximum outperformance results are visible after 6 to 12 months of conflicts, and as it happens, the current environment is a brewing barrel of conflicts.

Spade Index

I’ve listed a few examples of the geopolitical issues across the globe that can affect the U.S defense policy:

Spade’s April issue reports that:

Since the Russian invasion of Ukraine, Invesco’s Defense ETF (PPA) has more than doubled in size to more than $1.4 billion and provided returns more than 14% better than the market, which is currently down for the year. In fact, since 1997, investors have not lost money by investing in a Fund that tracks this index when holding for 30 months and reinvesting dividends. Every decline has been met by a swift rebound.

With an underperformance from 2020 to 2021, a record $813 billion defense budget for FY2023, and rising geopolitical tensions across the globe, the defense industry will follow these precedents and rise through the coming years.

Soaring Inflationary Pressures

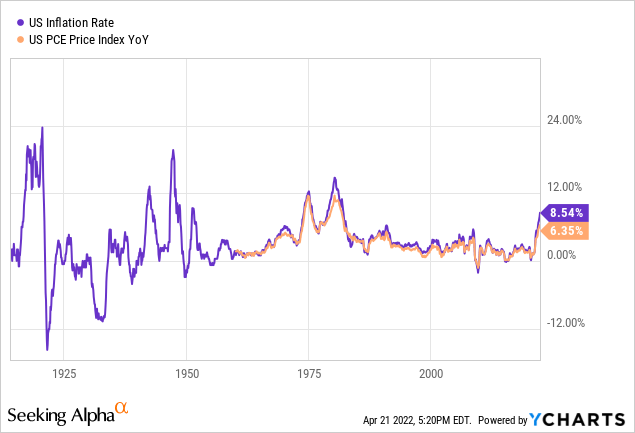

Inflation in the United States is at its highest point right now since 1978 in the wake of pandemic-related monetary stimulus packages, supply chain disruptions, and rising energy and other commodity prices. Moderate inflation is good for the stock market because it relays healthy economic growth, but high inflation is detrimental to the market.

Fannie Mae expects inflation to decelerate to 5.5% in Q4 2022 and the core PCE deflator down from 6.35% to 4.3% by the end of 2022 and 2.8% by 2023 as the Fed tightens its monetary policies.

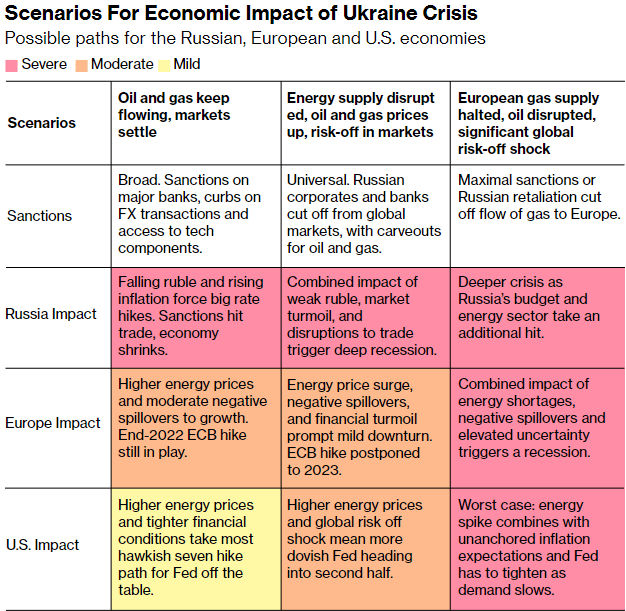

The inflation was already at 4-decade highs before Ukraine’s Russian invasion but has since taken to new heights as Russia is a major global oil and gas and wheat supplier.

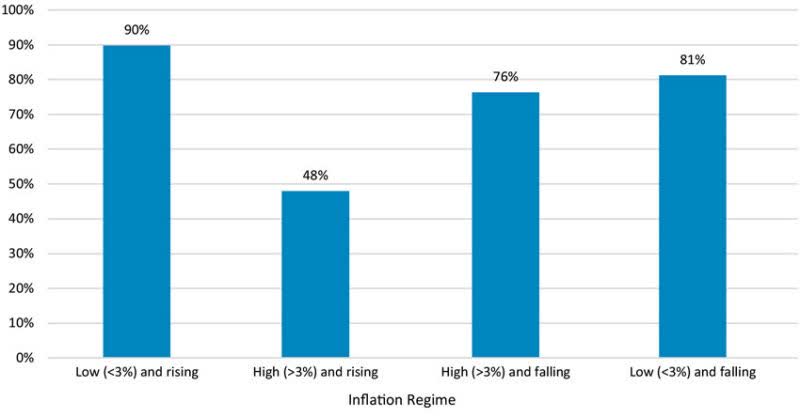

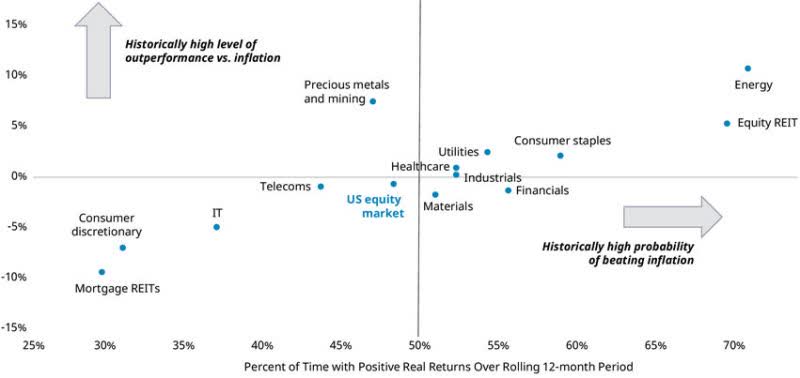

Aerospace and defense stocks have a high historical probability of beating inflation due to being a non-consumer industry. They are more resistant to inflationary pressures as they can pass higher input costs to their customers, primarily the government, accounting for 70% of the company’s revenue.

Hartford Funds

Either the economic recovery will experience a slowdown because of the inflationary pressures backed by the geopolitical situation, or the economic recovery will continue, curbing inflationary pressures. In both cases, the aerospace and defense industry benefits from these macroeconomic trends as a non-consumer cyclical industry.

General Dynamics Corp.

GD is a solid stock reaping all the benefits of buying into the US defense industry. It occupies a healthy market share of 8.15% in the aerospace and defense industry, trailing only Raytheon (RTX), Lockheed Martin (LMT), and Boeing (BA).

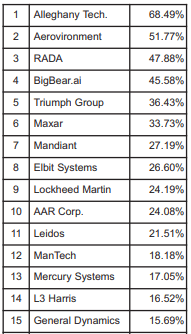

The company is the 15th best performing stock on the SPADE defense index year-to-date. However, 12 of the preceding stocks are low caps compared to the company, L3Harris (LHX), 14th on the list, has about $20 billion lower market cap, and the last is well… Lockheed Martin, 9th on the list.

SPADE Index

The company’s YoY topline growth of 1.4% resulted in revenues from $37.9 billion in 2020 to $38.5 billion in 2021. Meanwhile, the net income grew by 2.8% to $3.3 billion, with sequential growth in the operating margin to 11.52%. Its cash generation more than doubled with a 131% increase in cash from operations and a 104% FCF increase.

Rebounding Toward New Highs

GD’s aerospace segment took a massive hit when the pandemic diminished global air travel in 2020, resulting in the company’s sales and backlog dropping to $8.08 billion and $11.6 billion, respectively. However, it benefits from the rekindled spark in its aerospace as post-pandemic travel has resumed.

The aircraft demand has led to the company’s highest order level in over a decade, as evident by the aerospace segment’s book-to-bill multiple of 1.6x and Gulfstream’s book-to-bill multiple of 1.7x. Accordingly, in 2021, the sales moved about 0.7% to $8.14 billion from 2020, and the backlog is up 40% to $16.3 billion.

The company has reported that pandemic-related supply chain disruptions have become a bottleneck for its wing supply for Gulfstream, interfering with its ability to fulfill an ‘unprecedented demand.’ Even though GD has claimed that the issue will be resolved by 2023, an inability to do so will directly affect its revenue, resulting in a detrimental stock movement.

On the upside, if the company overcomes this bottleneck, I see this demand leading to all-time high aerospace segment performances per the company’s guidance of $8.4 billion in 2022, 10.4 billion in 2023, and $12 billion in 2024, with an operating margin of approximately 12.8%, 14.8%, and 15.8% in 2022, 2023, and 2024 respectively.

The company’s other revenue-generating segments are on a stably growing trajectory. The marine systems segment recorded its 17th consecutive quarter and 4th consecutive year of YoY revenue growth to $10.4 billion, up 5.5%. Combat Systems’ revenue grew 1.8% to 7.35 billion, and the Technology segment recorded a 1.5% decline in revenue to $12.5 billion.

GD Dividends

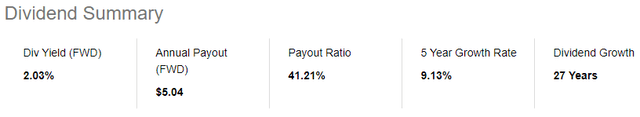

In a high inflationary environment, solid dividend-paying stock with a consistent yield ensures a nice short-term income while the equity appreciation takes care of the long-term gains.

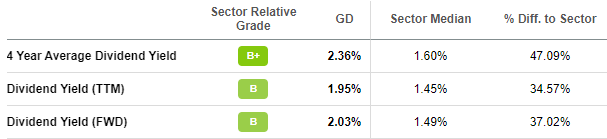

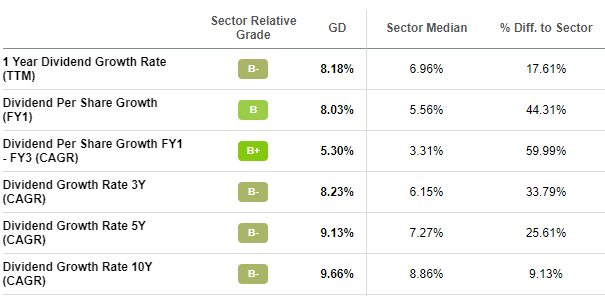

GD has both of these aspects covered with its $1.26 quarterly dividend, yielding almost 2.1% annually. This is almost double SPADE’s average dividend yield of 1.08% and over one-third higher than the industry median of 1.49%.

Seeking Alpha

The company has a 27-year track record of consecutive annual dividend growth. The steady financial performance can reasonably be assumed to continue increasing dividends, growing and yielding at higher levels than the industry median and its 5-year average.

Seeking Alpha Seeking Alpha

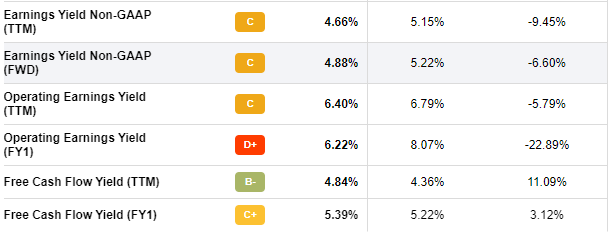

Even though the company’s earnings and cash flow yields are lower than the industry median, they are more than double its dividend yield, granting a strong dividend safety measure.

Seeking Alpha

Valuation

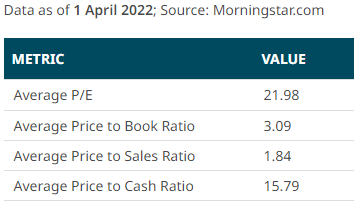

The company performs moderately against the industry medians, with marginally higher price ratios than the aerospace and defense sector. However, I find it pertinent to compare the company’s valuation metrics against SPADE’s averages. The company’s PE and PS multiples are marginally lower than the index average, while PB and PCF ratios are slightly higher.

Even after the recent rally, the stock appears to be adequately valued, with the price targets revealing an upside potential under 10%. However, given that the stock stands to benefit from both war and a steady decline in inflation, the upside gains are likely to be worth buying into the stock.

Conclusion

With the world arming itself, General Dynamics sits at the forefront to benefit from the market momentum. Despite gaining almost 17% YTD, the company is poised to utilize its defense market penetration to leverage the tense geopolitical situation and build on the precedent of outperforming the market during a conflict.

In the case of the tensions cooling down, the stock will benefit from the economic rebound that will result in inflationary pressures declining and aiding the company’s growth along with the economy.

Investors looking to get into a defense stock will benefit from the fair valuation metrics despite the recent rally and momentum. Moreover, the strong and consistent dividend also offers potential investors an incentive to dive into the stock.

However, as mentioned above, optimal gains of defense stocks are seen at least after a 12-month holding period, and for maximum gains, a holding period of at least 2.5 years is advised.

[ad_2]

Source link