Thinking of a home renovation, San Antonio? Construction material prices are more expensive than ever, with supply delays on top of that

Even after spending $698,000 to build their four-bedroom, four-bathroom “forever retirement home” near Boerne Stage Road, when construction ends and Gina and Robert Martinez move in in September, it won’t be quite finished.

Thanks to a perfect storm of events roiling the construction industry nationwide, the home will be missing several key components, like window treatments, a fence and pool.

Gina said the original quote they got in January for all the window treatments was $11,985. But when they went back to order them this month, it was up to $15,535. The quote for an iron rod fence jumped from $12,000 to $15,000. And the price for the pool jumped from $50,000 to about $55,000.

Across the country, homeowners building new houses, renovating old ones or simply freshening things up a bit are experiencing sticker shock as the price of virtually every type of construction material skyrockets. There’s a shortage of every type of building material, from lumber to steel to foam insulation, and prices for many such items have more than quadrupled over the past year or so.

At the same time, global production slowdowns and shipping delays mean buyers often have to wait weeks, even months longer than usual to take delivery on building materials and on products such as air conditioning units, windows, major appliances, furniture and more. According to data from the federal Bureau of Labor Statistics, 52 percent of contractors reported they were experiencing project delays caused by shortages of construction materials, parts or equipment.

The result? Even the smallest jobs cost more and are taking longer that ever to complete.

“I’ve been in the construction business for 25 years, and this is the worst it’s ever been,” said Bryan E. Smith, owner of the San Antonio-based home construction and remodeling company Vision Design and Build, which is building the Martinezes’ home. “The only thing I can still get at the same price these days are port-a-potties.”

There are reasons aplenty why the situation is so crazy — and why it’s not expected to resolve itself any time soon.

Everything started last year as the pandemic took hold. Anticipating the economy to tank, construction product manufacturers began ramping down their factories. And they were correct; demand tanked to virtually nothing — at least initially.

“In March and April (last year) it was crickets,” said Julie Risman, owner and lead designer of San Antonio-based The Inside Story Design.

Things started to pick up in May when folks working from home decided it was a good time for a renovation since they would be home to oversee the work, and low interest rates meant it was a good time to refinance their homes to fund that work.

“By August things were going gangbusters,” Risman said.

But even as demand surged, factories were slow to ramp up production as COVID-related lockdowns kept them from operating full shifts or reopening altogether. And just when work was getting stabilized enough to start to increase production, several singular events helped exacerbate the COVID-19-related shortages.

A massive wildfire season last summer in the West destroyed millions of acres of timberland and temporarily halted production at several mills. Then February’s arctic storms damaged petrochemical plants up and down the Gulf Coast. These plants produce chemicals used to make innumerable construction products, including spray-foam insulation, which has increased in price 30 percent, and polyurethane used in furniture.

As if that’s not enough, shipping troubles, highlighted by the week-long blockage of the Suez Canal by a grounded container ship, have exacerbated the situation.

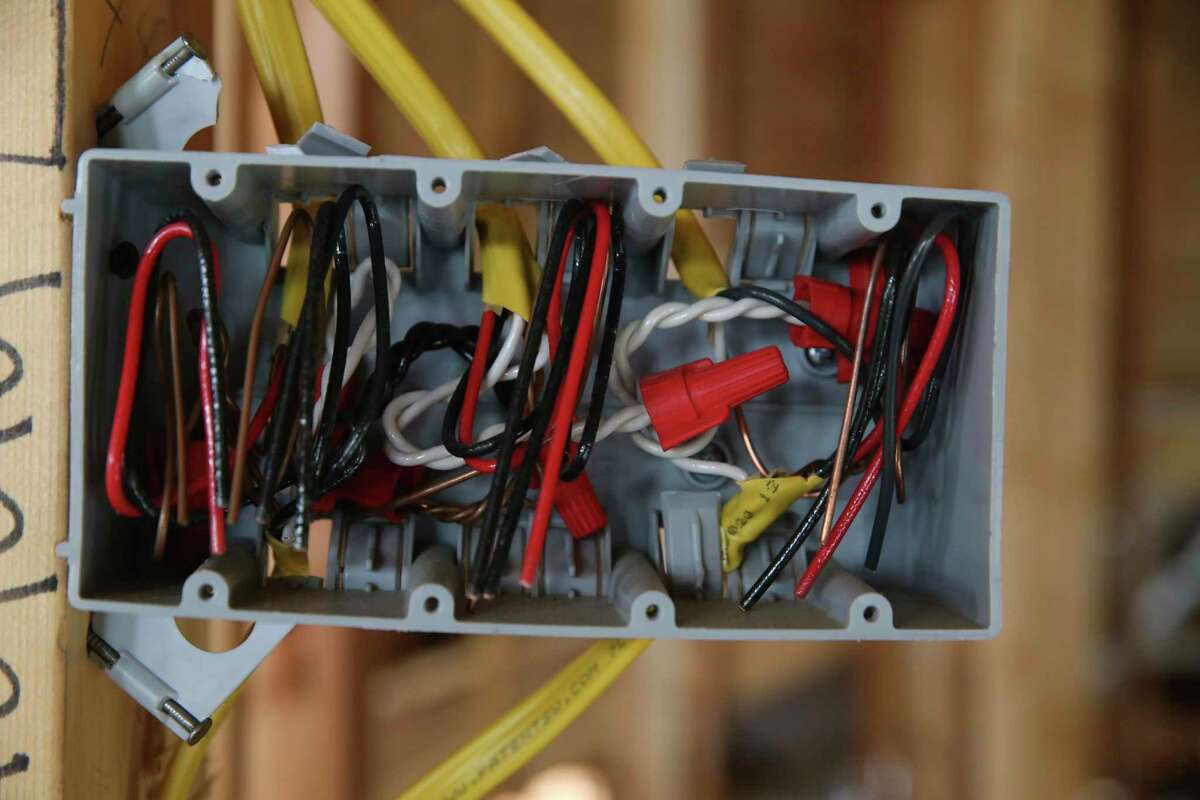

The cost of copper wiring, like this seen here in the home being built for Gina and Robert Martinez, has risen 160 percent in recent months as a perfect storm of events, including COVID, February’s freeze and plant closings, has caused shortages in construction products nationwide.

Jerry Lara /Staff photographerThe first sign that things were amiss, said Smith, were the price increases. Since April 2020, he said, the cost of 1,000 feet of lumber has jumped from about $260 to $1,600, a more than 500 percent increase.

“I’ve had clients who’ve seen their construction budgets increase $100,000 on lumber alone,” he said.

Other prices have increased as well. The cost of plywood is up from $7 a sheet to $45, foam insulation prices have gone up 30 percent and are expected to increase another 20 percent soon, and copper wiring has risen 160 percent.

But this isn’t the only thing throwing a wrench into the home construction and renovation business. Shortages of everything from major appliances like refrigerators to air conditioning units and outdoor furniture mean that getting a new one could take weeks or months, not just days.

The situation makes for a rude awakening for those accustomed to Amazon-like next-day delivery of all their wants and needs.

“We get customers coming in ready to buy, thinking they’ll have it tomorrow,” said Adam Kelley, vice president of outdoor furniture retailer Home & Patio. “We tell them unless they order something we have in inventory, it’ll be at least five months before they get it. We’ve got orders we placed last August that still aren’t in yet.”

Insulated windows adorn a staircase in the home being built for Gina and Robert Martinez. Builders are recommending that clients order products like these as early as possible during the construction process to ensure they arrive on time, or at least not too late.

Jerry Lara /Staff photographerBuilders and contractors are attempting to work around these problems by changing how they order. Trey Garner, owner of Garner Custom Homes, said he tells homeowners to select and order things like tile, plumbing fixtures and appliances at the beginning of a project, rather than wait and try to time it so they arrive right before they’re to be installed.

“If they have to sit around for a while, that’s OK,” he said. “I’d rather have that than have to stop work because something isn’t in yet.”

Smith said he tells clients to try to buy things made in the United States whenever possible. “It’s gotten horrible trying to get things shipped from China these days,” he said.

Juan Fernández, owner of home builder CVF Homes is not only taking slower delivery schedules into account for products — ordering windows six weeks before they’re needed instead of three or four, for example — he’s doing the same for human capital. “The plumbers we use are so busy, we have to get them on the schedule three weeks out, before we even begin framing the house,” he said.

The run-up in prices has forced some builders to spec different products, and sometimes that’s for the better. Until recently, for example, Fernández used coated plywood on the energy-efficient homes he builds. But when the price per sheet reached $50, he switched to an engineered sheathing called OX-IS.

“It costs about $38, so it’s not only more energy efficient, it’s also cheaper,” he said.

The good news, say builders and others in the construction industry, is there has been very little pushback from customers to these price increases and delivery delays — at least until recently.

“They don’t like it, but they’re seeing the news about how there’s all this demand and how events like the ship that got stuck in the Suez Canal are causing delays,” said Smith. “But I’ll tell, you, the prices especially are starting to hit people a little bit. They’re saying, ‘No, that’s a little too high.’ ”

Despite having to wait for the finishing touches for their home, the Martinezes feel lucky. Were they starting home construction now instead of last year, their $698,000 project would be 20 percent higher.

“I feel very fortunate how it worked out,” Gina said.

Editor’s note: This story and photo captions have been updated to correct and better explain the project costs for Gina and Robert Martinez’s home.

[email protected] | Twitter: @RichardMarini